Aptma chief raises concerns at textile industry decline with PM

October 5, 2022 10:39 PM

All Pakistan Textile Mills Association Patron-in- Chief Gauhar Ejaz has raised concerns at the decline of textile industry with Prime Minister Shehbaz Sharif.

The Aptma chief wrote a letter to the premier, pointing out the problems and their solutions.

Following is the letter text;

"Honorable Prime Minister,

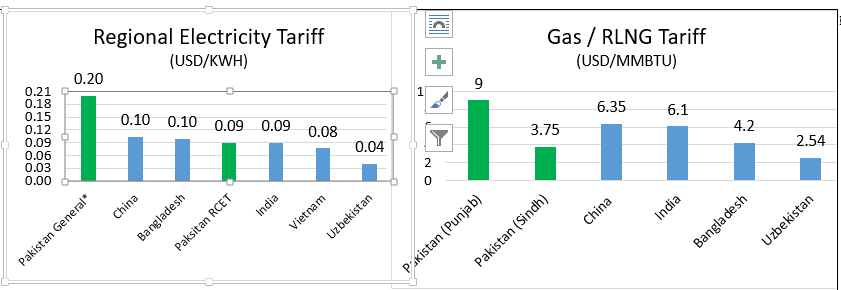

The Government’s commitment to the provision of the RCET Tariff of 9 cents/kwh for the FY22-23 electricity is not being honored. Power Division has notified discontinuation of the 9 cents tariff and this will lead to a charge of 20 cents/kwh starting October 1st, 2022. This has led to widespread dismay, panic and closure of factories across Pakistan.

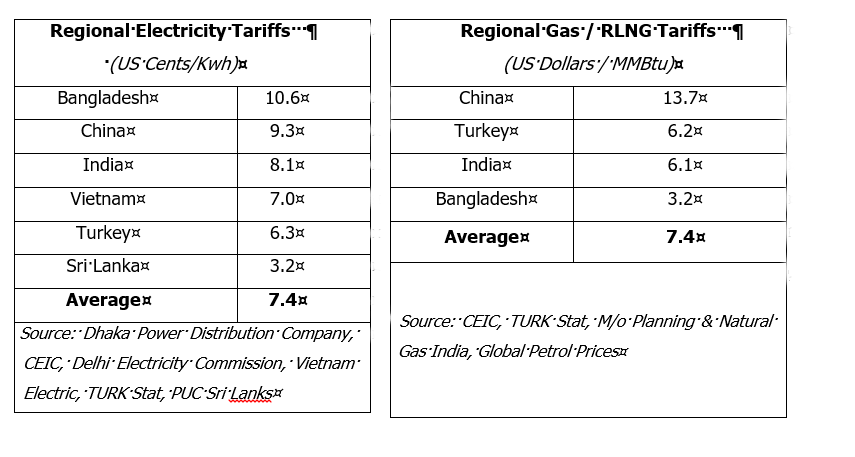

See also: APTMA announces countrywide closure of textile mills from Saturday

"Gas/RLNG being supplied to Punjab is priced at 9$ for less than 50% of the average consumption of mills last year. This formula irrationally excludes the new plants / expansion that have been made during the last 2 years. The Gas/RLNG being supplied to mills in Punjab is less than 1/3 of the required quantity of 200 mmcfd. At present, gas supply to Sindh export industry is supplied at $ 3.75/mmbtu (Rs 840) and at a quantity meeting 80% plus requirements. This is contrary to the commitment that differential in gas / RLNG pricing within the country will be less than 2 $ to keep Punjab industry competitive. This huge differential means that Punjab-based industry is paying for gas at 9 $ and electricity at 20 cents/kwh while bulk of Sindh industry is generating their own electricity at 4 cents / kwh.

"Given this differential Punjab-based industries are no longer viable and have no option but to close down as they are no longer competitive and available orders are shifting or in process of shifting to cheaper alternatives internationally and within Pakistan.

"The regionally competitive tariffs determined by the Ministry of Commerce as well as an independent study to be; Cents 7.4/kwh for electricity and $ 7.4/MMBTU for gas. Cognizant of Pakistan’s difficult financial situation the industry accepted the higher tariff of 9 $/ MMBTU and 9 cents/kwh electricity but cannot sustain higher tariffs that will result in closure of a major chunk of the installed capacity or under installation capacity of the country. RCET is not a “subsidy” under any interpretation as the RCET tariff is below the actual cost of service when cross-subsidies are eliminated. Any further increase in Tariffs will result in uncompetitive pricing, closure of industry, mass scale unemployment and much lower exports. The cost of providing RCET has been only 2.6 percent of exports value over the last 3 years. Provision of RCET for maintaining & enhancing exports is the cheapest and most efficient means of enhancing forex availability for a sustainable Balance of Payments.

"Under these difficult circumstances, an estimated 3 to 5 million direct employees of the Textile Sector are going to lose their jobs who are the breadwinners of 15 to 20 million people. This catastrophe/ human tragedy can still be avoided if remedial action is taken and appropriate government policies are aggressively implemented.

Furthermore, international demand has weakened at the onset of a worldwide recession, and without price competitiveness, it is not possible for Pakistan’s textile sector to retain its market share. Input prices need to be lower to prevent a reduction in market share which would be difficult to regain when things turn around.

Working Capital / Zero Rating

Working capital requirements has increased by more than a 100% due to the sharp rupee devaluation yet working capital facilities have not been enhanced. Adding further injury, Sales Tax refunds have not been made by FBR since 13th September 2022, while a very significant amount has accumulated as “deferred Sales Tax”. This has clearly demonstrated that the payables and refund system in Pakistan cannot be relied upon. The export cycle lasts up to 5-6 months wherein the liquidity of the sector remains tied up in the process of sales tax till refund (6 months). In FY22, the total amount retained by FBR as sales tax on domestic sales was only Rs 50 billion out of the Rs 249 billion collected. Approximately, Rs 250 billion of the industry remains with the FBR at all times as a result of this collection and refund mechanism. We, therefore, request the government to restore SRO 1125 and release the Rs 250 billion of the industry to meet the enhanced working capital requirement.

Non- functioning of new projects/ expansions

Over the past 2 years the textile sector has invested $5 billion (Rs. 1 trillion) in setting up new factories, some of these are now complete and the others are in process however some of the machinery of new plants/ expansions is still stuck at ports, L/Cs are being delayed for spare parts, and electricity and gas is not being provided to these new units. If remedial action is not taken non-functionality of this new investment instead of increasing exports by $ 5 billion per annum is likely lead to massive banking defaults, complete loss of investor confidence in future for any investment in Pakistan with many other negative consequences.

Imports under Chapter 84-85

We have been writing and holding meetings with the Ministry of Commerce and State Bank of Pakistan regarding pending cases of a large number of critical imports of machinery and raw materials. SBP is now stating they will release for imports under Chapter 84-85 only to direct exporters and indirect exporters are neglected which is a matter of grave concern as indirect exporters provide intermediate goods to exporters. Without these intermediate goods exports are now suffering and will drop significantly over time as this will result in shutting down of mills due to lack of maintenance.

We request the Government to ensure;

1. Announce uninterrupted and adequate gas & electricity at Regionally Competitive Energy Tariffs across the country & entire value chain for the full FY22-23.

2. Restoration of zero rating (SRO 1125) to restore liquidity of the textile sector.

3. Comprehensive policy and action for realization of enhanced export potential of $5 billion/annum through Rs. 1 trillion invested in new projects, expansions & upgradation

4. Release of material under chapter 84-85 stuck at ports and SBP to allow all Export Oriented Sectors to open L/Cs without pre-approval."

Mexican claims victory by paying $28 for $28,000 Cartier earrings

Mexican claims victory by paying $28 for $28,000 Cartier earrings Two Railway Police personnel killed in Mardan

Two Railway Police personnel killed in Mardan Gunmen storm Lucky Cement factory, kill security guard

Gunmen storm Lucky Cement factory, kill security guard When Pakistani pilot shot down Israeli fighter plane

When Pakistani pilot shot down Israeli fighter plane Relationships are tough; Mrunal Thakkur plans to freeze her eggs

Relationships are tough; Mrunal Thakkur plans to freeze her eggs Arbaaz Khan hands ‘winning’ response to ex-wife Malaika Arora for labelling him Indecisive

Arbaaz Khan hands ‘winning’ response to ex-wife Malaika Arora for labelling him Indecisive