US dollar crosses Rs230 barrier in interbank trading

January 23, 2023 12:36 PM

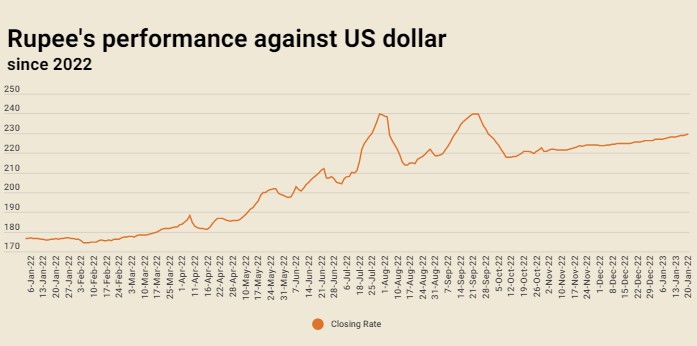

The Pakistani rupee continued to suffer drubbing at the hands of US dollar as the greenback on Monday crossed the Rs230 barrier in the interbank trading, reported 24NewsHD TV channel.

As the trading started in the money market, the US currency kept its dominance on the local unit. The USD gained 48 paisas in its value and ended the day att Rs230.15.

This is the 24th straight fall of the Pakistani rupee in the interbank business against the greenback.

https://twitter.com/StateBank_Pak/status/1617467423351009281

On Friday, the last trading day of the previous week, the value of the US dollar was appreciated by 52 paisas against the Pakistani rupee making the greenback to conclude the day at Rs229.67 in interbank trading.

https://twitter.com/StateBank_Pak/status/1616380201252061184

The currency experts believe that the rate of dollar is soaring due to mounting demand for import payments. Besides this, falling inflows under exports and remittances and political uncertainty also resulted in devaluation of the rupee.

Pakistan’s economic banes along with its imminent threat of default will not go away unless the IMF agrees to resume its ninth review for the extended loan facility.

The government has requested the IMF (International Monetary Fund) mission to come soon and conclude the pending 9th review. There is certain set of economic steps that are required by authorities to take for the IMF mission to come to Islamabad to finalize the all-important service level agreement.

As per the report, the government finally has made up its mind to come up with a mini-budget and address other concerns of the IMF that are set to further stoke up inflation.

The State Bank is scheduled to issue a monetary policy announcement today as the market is expecting another hike of 100 basis points to bring the benchmark rate to 17 per cent. The increase in policy rate is expected due to elevated inflation in December 2022 as Consumer Price Index (CPI) clocked in at 24.5 per cent against 23.8 per cent in November 2022.

Reporter Ashraf Khan

Yet another burden on people: Govt hikes oil prices

Yet another burden on people: Govt hikes oil prices Adil Raja loses pleas to dismiss Naseer’s defamation suits

Adil Raja loses pleas to dismiss Naseer’s defamation suits Nadeem Mahboob named federal health secretary

Nadeem Mahboob named federal health secretary Amir Tanba, linked to Indian spy Sarabjit Singh's jail killing, killed in Lahore

Amir Tanba, linked to Indian spy Sarabjit Singh's jail killing, killed in Lahore Team formed to probe woman’s death after tortured by cop on train

Team formed to probe woman’s death after tortured by cop on train Public reacts to Bohemia's music video ‘Salsa’ starring Sistrology

Public reacts to Bohemia's music video ‘Salsa’ starring Sistrology