KSE-100 plunges to lowest level since Dec 2020 amid political turmoil

May 24, 2022 08:10 PM

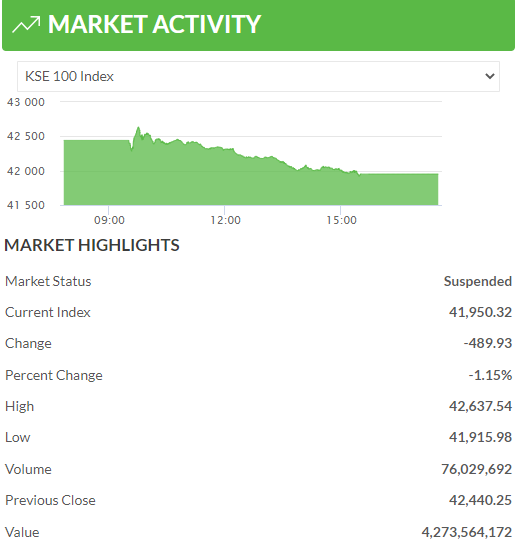

Pakistan Stock Exchange (PSX) saw another red Tuesday as the benchmark KSE-100 index lost nearly 500 points or 1.15%, to close below the 42,000-barrier for the first since December 2020, reported 24NewsHd TV channel.

In the backdrop of an unsatisfactory economic scenario, coupled with a deepening political crisis, the index fell below the 42,000-point mark. The stock market shed 489.9 points to close at 41,950.32.

Economic uncertainty following the hike in a benchmark interest rate and the delay in the outcome of talks with the International Monetary Fund (IMF) impacted the investment climate.

On the political front, the investors kept a close eye on the developments regarding PTI’s ‘Azadi March’ scheduled to begin tomorrow (May 25).

The depreciation of the rupee against the US dollar and depleting foreign exchange reserves, as reported by the State Bank of Pakistan, coupled with a gloomy economic outlook aided the bearish sentiment.

A report from Arif Habib Limited noted that the benchmark KSE-100 index opened negative and witnessed a volatile session throughout the day due to concerns over foreign exchange reserves and a rate hike in the monetary policy statement which pulled off confidence among investors.

“The market continued to remain under pressure as investors opted to remain on the sideline until further clarity on the political as well as economic front,” it stated.

The brokerage house noted that the volumes remained dry throughout the mainboard whereas, healthy volumes were observed in the third-tier stocks.

Sectors contributing to the performance included banks (-108.8 points), technology (-74.8 points), cement (-72.1 points), fertiliser (-56.2 points) and chemical (-25 points).

https://twitter.com/ArifHabibLtd/status/1529060577640951808

Shares of 318 companies were traded during the session. At the close of trading, 94 scrips closed in the green, 208 in the red, and 16 remained unchanged. Overall trading volumes rose to 169.70 million shares compared with Monday's tally of 118.98 million. The value of shares traded during the day was Rs5.46 billion.

https://twitter.com/ArifHabibLtd/status/1529078300370427904

Pakistan Refinery was the volume leader with 15.73 million shares traded, gaining Rs0.46 to close at Rs15.74. It was followed by Silk Bank with 14.66 million shares traded, gaining Rs0.07 to close at Rs1.39 and TPL Properties with 10.60 million shares traded, gaining Rs0.38 to close at Rs15.49.

Maryam Nawaz can wear uniform!

Maryam Nawaz can wear uniform! Here is all about Madiha Rizvi’s second husband

Here is all about Madiha Rizvi’s second husband Madiha Rizvi ties the knot again

Madiha Rizvi ties the knot again Zara Noor Abbas inspired by Rani Mukerji

Zara Noor Abbas inspired by Rani Mukerji Humayun Saeed and Saboor Aly under fire for close interaction in public

Humayun Saeed and Saboor Aly under fire for close interaction in public Two patients die, injuries of 12 others multiplied after roof collapse at Gujrat hospital

Two patients die, injuries of 12 others multiplied after roof collapse at Gujrat hospital